As a self-taught process engineer, I have come to appreciate the role of processes in improving any organization, one way of ensuring quality in organizations is through continuous process improvement and process re-engineering.

Am also very passionate about space travel and space engineering, I have on many occasions watched the precision and due diligence taken when launching space vessels, I have also watched videos showcasing the production of space ships and space engines, and I have come to appreciate the importance of quality assurance in designing and planning, why? because in space travel and engineering you have to be 100% in everything from the start to the end; because it is very costly to build rockets and space capsules, with the costs in billions of dollars, recently I was watching an interview by Elon Musk and he said each rocket launch costs about $2.5 Million, making space travel very expensive and very risky, therefore the lag for mistakes/ errors/ defects is 0%.

In pursuit of quality and as Quality Assurance specialist, I have become so passionate about two major process management methodologies, these when applied in any industry they not only ensure quality, but they also help organizations reduce costs, improve customer satisfaction and also profitability. I have also used the same methodologies in my tax practice, especially in designing the Tax planning matrix that we use at CMSL, and a few years back as a tax administrator I used them to identify cases for tax audits and for Compliance Improvement Plan as well Return Examinations. These two methodologies are Lean Management and Six Sigma.

Lean management aims at improving businesses through the early detection of waste and through continuous improvement of processes, it relies on five pillars; continuous improvement, respect for people, automation, elimination of waste, and team work.

Six sigma looks at improving businesses by removing process variations and defects, it’s a five step methodology (DMAIC) that uses statistical methods and quality management techniques to enable organizations streamline their processes and out puts.

With six sigma an improvement project is determined and the probable causes of problems are Defined through data collection, the data obtained is Measured used various statistical methods like the mean, standard deviations, etc then the data is Analyzed through data charts, graphs, etc from the data supported causes of variations, Improvements are suggested and implemented, and Controls are put in place through Standard Operating Procedures. Six Sigma provides a number of tools that we can use to improve processes and ensure quality out puts (Compliance and Tax saving Strategies), these include; 5 whys, fish tree diagrams, the SIPOC Model, etc.

At CMSL we have divided our tax practice into three core functions; Tax Support, Tax Planning and Tax Advisory. Our Tax niche is Tax planning; we do proactive forecasting of a business’ transactions to find tax risks and find strategies to mitigate them, and also take advantage of the prevailing tax incentives and tax law lapses to create tax savings for clients and also ensure that the taxpayer is complaint before the Revenue Authority.

We have further subdivided the tax planning function further into Standard Tax planning and Advanced Tax planning. With Standard tax planning we look at basic tax planning by reviewing a client’s inputs, processes and tax errors to provide tax saving strategies, and for Advanced Tax planning we look at reviewing inputs, processes and ensure minimal tax errors/ omissions inline with the legal frame work to find strategic tax advantages for clients that can lead to tax savings without evading or avoiding tax.

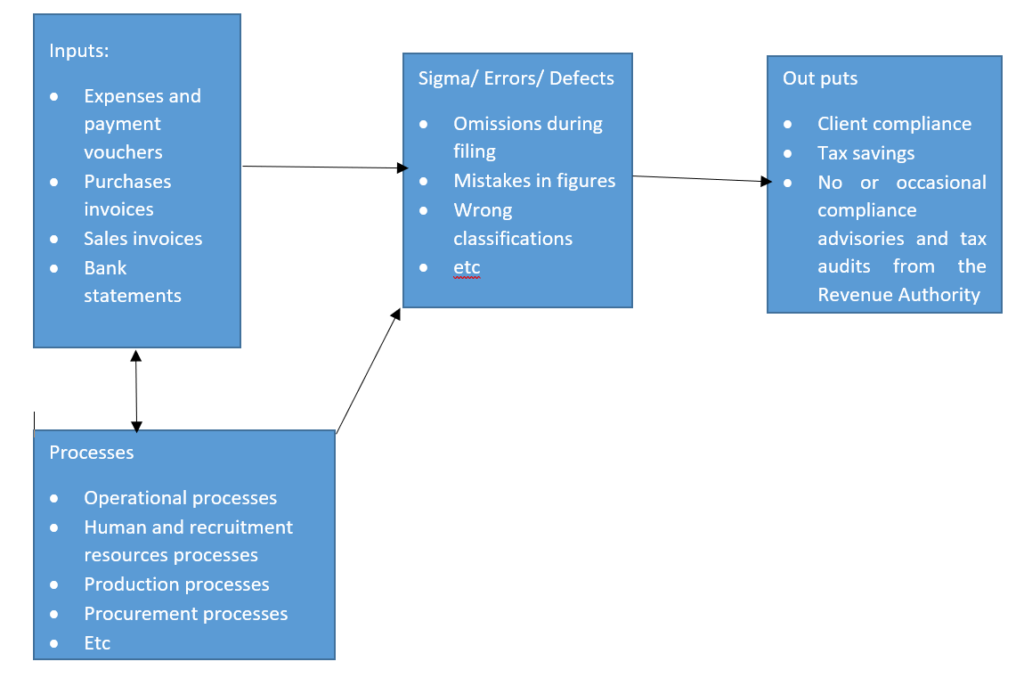

We have developed a tax planning matrix that we use to make high quality tax decisions. The matrix has been developed by combining tools from both six sigma, lean management and Total Quality Management (TQM), we use the following formula in our matrix to find quality tax saving strategies for our clients and also ensure client compliance.

QI+QP-&=QO (Quality Inputs+Quality Processes-Sigma (Errors/Defects/Variations) = Quality Outputs (Tax compliance and Tax saving strategies) for Standard Tax planning,

[(QI+QP-&)] +Legal Frame Work= Quality Out Puts (Tax compliance and Tax saving strategies) for the Advanced Tax Planning.

From this matrix we have the independent variables (Inputs and Processes), and the controlling variables which have to be studied and regulated (sigma/ errors/ defects/) and the dependent variables which are out puts. Therefore, we have to ensure that the inputs and processes are exhaustively reviewed and improved, and also ensure that we control/ reduce the errors so that we can generate quality tax saving strategies and ensure tax compliance for our clients.

CMSL Standard Tax Planning Model

In physics, Newton’s third law of motion states that, “for every action there is an equal and opposite reaction”, in process engineering there is a principle that states “For every input processed, there is an expected output”, when inputs are processed in the right conditions they should provide the right out puts. Garbage in, garbage out, quality in, quality out.

It is important to understand that before we consider what tax is to be paid, we need to understand what causes tax to be paid. One of the major compliance problems for companies, is they want to predetermine what tax to pay before they understand what inputs and processes are responsible for arriving at that specific tax. Many taxpayers will always tell their tax consultants, “this financial year I will only pay Ugx 2million in income tax, makes sure the return does not exceed that amount” but they do not understand that before you arrive at a tax payable of 2million there are inputs and processes to be considered that may make it possible or impossible to arrive to this amount that you have already predetermined, secondly if you did not plan in advance how to arrive at a certain tax liability, it is difficult after you have finished transacting to get there, there needs to be a clear and precise plan how you want to get into a safe tax bracket or zone as we call it at CMSL.

I had a client and friend, who approached me for tax help, he told me he needed to have his company’s tax returns prepared, however confidently told me he was only prepared to pay only Ugx 5 million in income tax for that period. I told him to provide me the business records specifically the audited books of accounts or management accounts, and also to provide me with the company operational manuals and SOPs (Standard Operating Procedures), because I needed to understand how we were going to arrive at this tax that he wanted to pay. He was very open and he told me all he had were sales receipts, the purchases invoice and a few invoiced expenses, the company had neither audited books of accounts nor management accounts, for the operational manuals and SOPs he told me he had never had about them at all. Well I took a look at the documents he provided me with and discovered the following information; in that specific year the company had made sales of Ugx 2 billion, which had been fiscally invoiced, they had purchases of about Ugx 700M, a few expenses recorded amounting to about Ugx 60M, I used this data and made a quick run through for him and provided him the following information as per the table below:

| Item | Amount | |

| Sales | 2,000,000,000 | 120,000,000.00 (WHT) Credits |

| Cost of sales | 700,000,000 | |

| Gross profit | 1,300,000,000 | |

| Less: Operating Expenses | ||

| Operating expenses | 60,000,000 | |

| Net Profits | 1,240,000,000 | |

| Income Tax @30% | 372,000,000.0 | |

| Tax payable after deductions of WHT Credits | 252,000,000.00 |

From the information he had a tax exposure of about Ugx 252M in income tax, he was already due for registration of VAT and had not registered, all he wanted was to pay 5 Million in taxes, he wanted magic to happen and miracles to come from heaven and turn 252 into 5 million without any consequences or tax implications like assessment and penalties.

I advised him that we take the process approach to arrive at the proper tax zone instead of just dreaming of an amount that would have dire consequences if reviewed by the Tax authority, he agreed and we had to go through the whole business looking at each process unit, together with him and staff.

What we discovered was shocking not only to us but also to him, most of the inputs (expenses and purchases) were not being documented, he employed staff whose salaries were never recorded and the company had not even registered for PAYE nor NSSF, he had paid consultants a lot of money but there was no evidence of these payments and he had not charged, collected and paid WHT on these supplies, he incurred expenses that had no entry vouchers so they could not be accounted for and thus we could not include them in the allowable expenses, there were no bank reconciliations, the costs relating to hire of machinery were not recorded, etc and even the few documents that were recorded there were a lot of errors, since his brother who had no accounting background was handling all the accounting work, and at the same time the one managing the site operations, therefore he made alot errors in the entries, the whole company was a mess, there were no defined processes and systems, no work manuals, no systems, not even the basic accounting system like QuickBooks, there was totally no accountability at all. We also later discovered that in the previous financial year actually they had filed a presumptive return for meant for small businesses that have revenue less than Ugx 150M in a financial year, and paid tax of Ugx 500,000 against an income of about 800M; unfortunately, URA had issued them an additional assessment of about Ugx 120M.

From these findings I told my dear friend I was not going to prepare the return, unless he agreed we do a proper input and process realignment of the company, to which he agreed. From the records he also accepted that indeed what he wanted was not only impossible but it would have more troubling effects on the company in the future as it had happened in the previous financial year where the company was assessed. We agreed that we start a process re-engineering project to get the company organized and running efficiently and then we can prepare accounts and file the return considering the various tax incentives and tax gaps in the law to reach a favorable tax position for the company, without compromising its compliance.

There are many companies in this kind of state, and year and year they are always issued compliance advisories and they are always on the URA Tax audit plan, such companies have piled up huge tax arrears and when analyzed, almost 80% of these arrears amount are coming from additional assessments.

My dear friend understood the importance of processes, he understood that tax planning is not an event but rather a continuous process, he also appreciated that tax planning has to be done every year, as tax law keeps changing time and time again. Luckily enough being an engineer he understood this, just like in construction you cannot build a house without a firm foundation, even in taxation you cannot have tax planning unless you understand the processes and the inputs that are used to run the business you are planning for.